charitable gift annuity example

Annuities are often complex retirement investment products. Tufts University follows the gift annuity rates set by the American Council on Gift Annuities.

Pin On Higher Ed Marcomm Ideas

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12027 the amount of the 25000 donation.

. Annuities are often complex retirement investment products. An Example of How It Works. She establishes a charitable gift annuity of 25000.

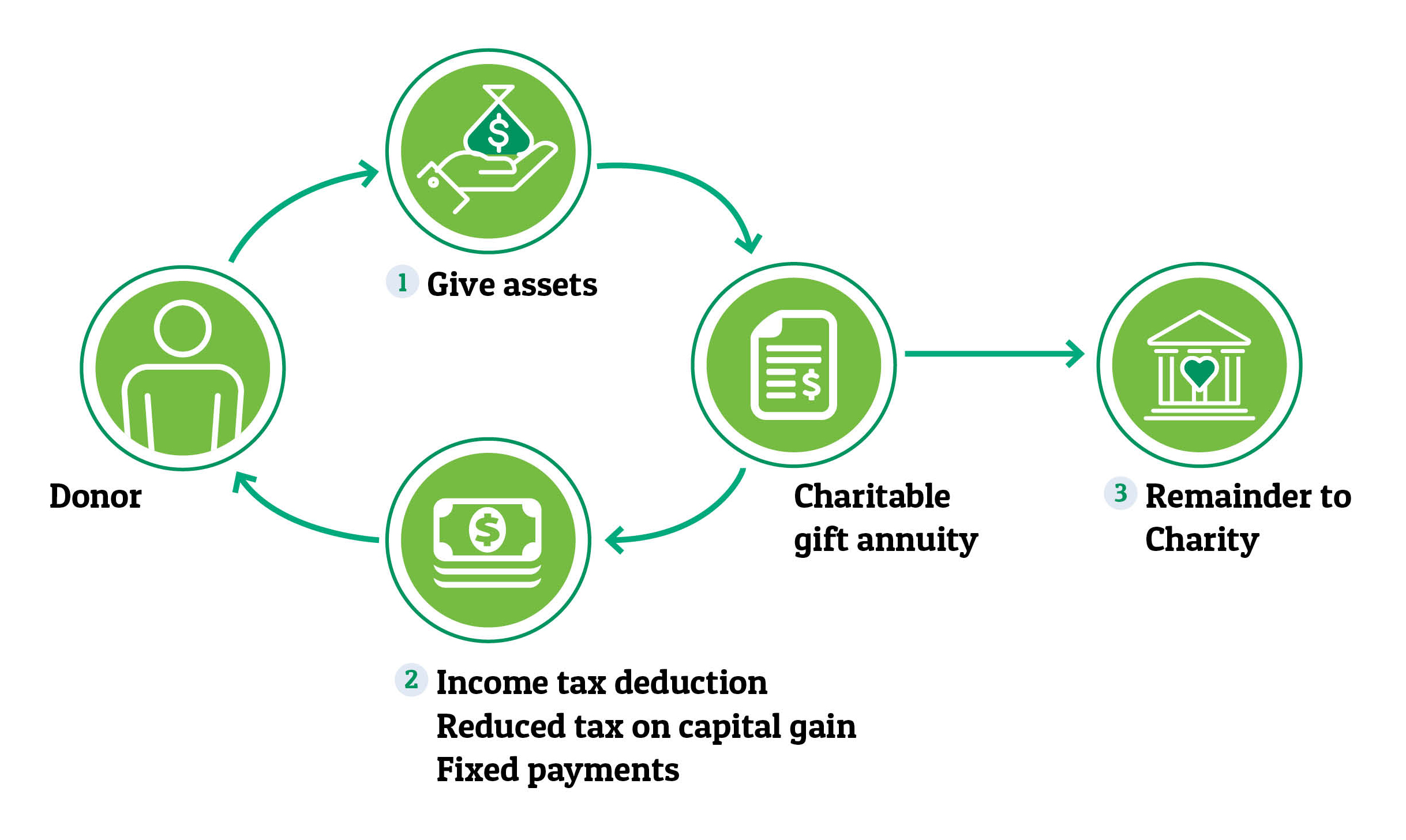

An example of a CGA at Georgetown. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Charitable Gift Annuity.

Definition and Example of a Charitable Remainder Annuity Trust. A charitable gift annuity allows you to support the National Park Foundation and receive payments in your retirement years. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

7 rows Susan would like to provide her mother Esther 80 with additional income but knows that her. State tax liability is not. This gift annuity shall be designated in a separate fund agreement signed by the Donors and the Foundation.

Ann a 77-year-old woman who loves animals decides to cash in a maturing certificate of deposit. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12027 the amount of the 25000 donation. Charitable Gift Annuities An Example.

An alum is looking to secure her finances in retirement. A graphic illustration of a charitable gift annuity is available. Summary of Benefits for Alice Gift Annuity.

You transfer cash securities or other property to a trust. Simply input the amount of your possible gift the basis of the property and the. A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets.

Learn some startling facts. Charitable Gift Annuities An Example. Ad Get Guaranteed Quotes From Over 25 Top Rated Companies.

As we discussed the way a charitable gift annuity works is that you make a gift of 20000 or greater most commonly with cash or readily marketable appreciated stock you have owned. Because they need continuing income they decide to give the cash in exchange for a one-life. You receive an income tax deduction and pay no capital gains tax.

Under the current rate schedule Mary 79 transfers 25000 in exchange for a charitable gift annuity. Barbara received annual payments of 1225 a rate of 49. Given her age and.

This type of trust is a financial. An example of a Charitable Gift Annuity for an individual annuitant. Charitable Gift Annuities An Example.

The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Find a Dedicated Financial Advisor Now. With the new rates.

Our donor age 75 plans to donate a maturing 25000 certificate of deposit to Loyola Marymount University. She will receive annual. Statement describing the material terms of.

Example of Charitable Gifts Annuity Rates Annual Giving. Dennis 75 and Mary 73. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to Feeding America.

New Look At Your Financial Strategy. Do Your Investments Align with Your Goals. With the old rates.

Learn some startling facts. Heres an Example of How You May Benefit. Charitable gift annuities as with all things have benefits and risks.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Alice age 70 agrees to a gift of 20000 to Unbound in return for life income. Because they need continuing income they decide to give the cash in exchange for.

Fox example future income payments are subject to the ability of the. Visit The Official Edward Jones Site. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Barbara 72 transfers 25000 in exchange for a charitable gift annuity. Is a charitable gift annuity right for you. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

As with any other. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12027 the amount of the 25000 donation. A charitable remainder annuity trust CRAT is an option for estate planning.

She has a nest egg of 25000 that she would like to give to Georgetown while also receiving fixed. Example assumes a 34 percent applicable federal rate AFR and a federal income tax bracket of 35. Example of a Charitable Remainder Annuity Trust.

Charitable Gift Annuities Giving To Stanford

Charitable Gift Annuities Development Alumni Relations

Metlife Logo Logotype Logok Logo Design Trends Logo Design Logo Design Creative

Gift Calculator Community Foundation Of Southern Indiana

Charitable Gift Annuities Maryknoll Fathers Brothers

Browse Our Example Of Socratic Seminar Lesson Plan Template Lesson Plan Templates How To Plan Socratic Seminar

Gifts That Pay You Income The Salvation Army Western Territory Arc

Charitable Gift Annuities National Wildlife Federation

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Charitable Gift Annuity Immediate University Of Virginia School Of Law

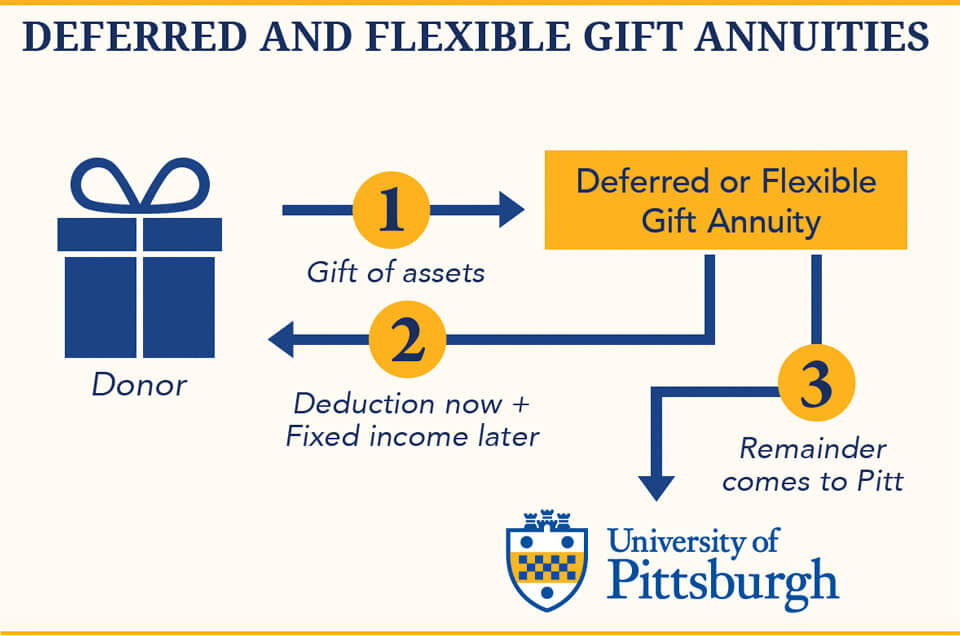

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuity Penn Medicine Planned Giving Perelman School Of Medicine At The University Of Pennsylvania

Charitable Gift Annuity Saint Paul Minnesota Foundation

Life Income Plans University Of Maine Foundation

Planned Giving Calculator Harvard Alumni

Charitable Gift Annuity Penn Medicine Planned Giving Perelman School Of Medicine At The University Of Pennsylvania